The Short Strangle option strategy is a versatile trading strategy that can generate income and manage risk in the options market. By utilizing this strategy, traders aim to profit from a sideways market, where the underlying asset’s price remains within a specific range. This comprehensive guide will provide you with a detailed understanding of the Short Strangle strategy, its benefits, mechanics, risk management techniques, market analysis considerations, and practical tips for successful implementation.

Table of Contents

Understanding Options Trading Basics

To comprehend the Short Strangle strategy, it is crucial to have a solid understanding of options trading fundamentals. Options contracts, which are derived from underlying assets, can be classified as either call options or put options. Call options provide the holder with the right to buy the underlying asset at a predetermined price (strike price) within a specified time frame. Put options, on the other hand, give the holder the right to sell the underlying asset at a predetermined price within a specified time frame.

Exploring Volatility and its Role in the Short Strangle Strategy

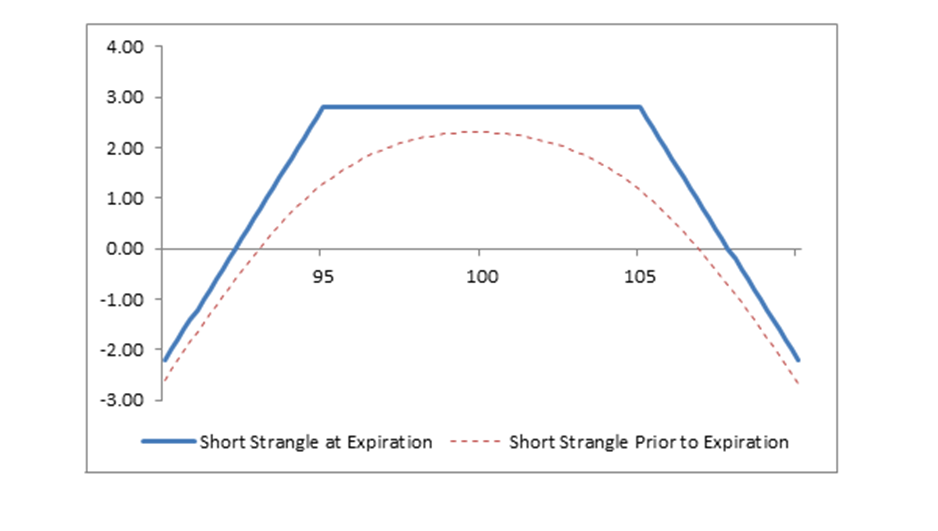

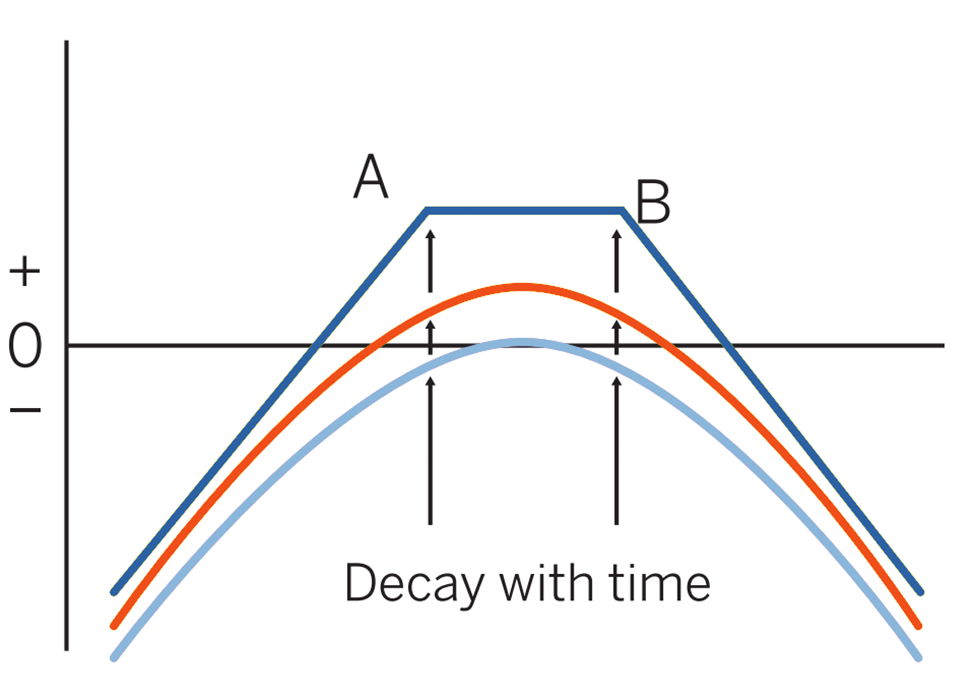

Volatility plays a significant role in the Short Strangle strategy. It refers to the magnitude of price fluctuations in the underlying asset. Implied volatility, which is derived from options pricing models, indicates the market’s expectation of future volatility. Traders utilizing the Short Strangle strategy aim to benefit from relatively low volatility environments, where the underlying asset is expected to trade within a narrow price range.

The Mechanics of the Short Strangle Strategy

The Short Strangle strategy involves selling an out-of-the-money call option and an out-of-the-money put option simultaneously. The trader receives premiums from both options, creating a credit. The call option is sold above the current market price, while the put option is sold below the current market price. This strategy aims to profit from the time decay of options and a decrease in implied volatility, as long as the underlying asset remains within the range defined by the strike prices.

Risk Management in the Short Strangle Strategy

While the Short Strangle strategy offers potential rewards, it also involves inherent risks. Traders must assess potential risks and losses associated with this strategy. Implementing stop-loss orders and adjusting positions when necessary can help manage risk effectively. Diversification and proper position sizing are essential considerations to mitigate risk exposure.

Analyzing Market Conditions for Short Strangle Strategy

Successful implementation of the Short Strangle strategy requires a careful analysis of market conditions. Traders need to consider market trends, support and resistance levels, technical indicators, and chart patterns. Fundamental analysis factors, such as earnings reports and economic news, can also influence the strategy’s performance.

Monitoring and Adjusting Short Strangle Positions

Active position management is crucial in the Short Strangle strategy. Traders should monitor their positions regularly, assess profits and losses, and have predefined exit strategies. Rolling the position forward by adjusting strike prices and expiration dates can help adapt to changing market conditions. Additionally, traders need to be prepared for potential assignment or options exercise.

Case Studies: Real-Life Examples of Short Strangle Trades

To provide practical insights into the Short Strangle strategy, this section presents three case studies:

- Case Study 1: Bullish Market Scenario – Demonstrating how the Short Strangle strategy can be profitable in a bullish market with limited price movement.

- Case Study 2: Bearish Market Scenario – Illustrating how the Short Strangle strategy can generate income in a bearish market environment.

- Case Study 3: Sideways Market Scenario – Exploring how the Short Strangle strategy thrives in a sideways market, generating consistent income.

Tips and Best Practices for Successful Short Strangle Trading

Successful Short Strangle trading requires a combination of knowledge, discipline, and effective decision-making. Here are some tips and best practices to enhance your trading experience:

A. Patience and Discipline:

- Exercise patience when selecting trades and avoid rushing into positions.

- Stick to your predetermined trading plan and avoid impulsive decisions.

- Maintain discipline by following risk management principles and sticking to your exit strategies.

B. Practicing Proper Position Sizing and Risk Management:

- Determine the appropriate position size based on your risk tolerance and available capital.

- Avoid overexposing your portfolio by diversifying across different assets and strategies.

- Set stop-loss orders to limit potential losses and protect your capital.

C. Learning from Mistakes and Adaptation:

- Keep a trading journal to record and review your trades, including both successes and failures.

- Learn from your mistakes and identify patterns or areas for improvement.

- Stay adaptable and be open to adjusting your strategy based on changing market conditions.

Frequently Asked Questions (FAQs)

A. What is the difference between a short strangle and a short straddle?

- A short strangle involves selling out-of-the-money call and put options simultaneously, while a short straddle involves selling at-the-money call and put options simultaneously. The short strangle has a wider range for potential profit but also carries higher risk.

B. How do I select the appropriate strike prices for a short strangle?

- The selection of strike prices depends on your risk appetite and market analysis. Generally, strike prices are chosen outside the expected price range of the underlying asset, with the call option strike price above and the put option strike price below the current market price.

C. Can the short strangle strategy be applied in all market conditions?

- The short strangle strategy is most effective in sideways or range-bound market conditions with relatively low volatility. It may not be suitable during periods of high volatility or strong directional trends.

D. How often should I monitor my short strangle positions?

- Regular monitoring is essential to assess the performance of your positions and adjust as needed. The frequency of monitoring depends on your trading style and market conditions but should be done at least daily or weekly.

E. What are the alternative strategies to the short strangle?

- Alternative strategies include the short straddle, iron condor, and butterfly spread. Each strategy has its own characteristics and risk-reward profile, so it’s important to understand them before implementing them.

Conclusion

The Short Strangle option strategy offers traders an opportunity to generate income and manage risk in sideways market conditions. By understanding the basics of options trading, analyzing volatility, and implementing effective risk management techniques, traders can navigate the market with confidence. Through continuous learning, adapting to changing market conditions, and adhering to best practices, traders can enhance their success in implementing the Short Strangle strategy. Remember to always conduct thorough research and consult with a financial professional before making any investment decisions.